**Updated 9/11/16

I’m continually updating a list of items that people constantly ask me whether or not they should purchase.

While getting out of debt, a lot of time in the financial community, we like to pretend like throughout the duration of someone’s debt free journey, that they will purchase absolutely nothing. While this would be great and definitely help that person get out of debt faster, we know in practice that this just isn’t the case.

With that being said, students within BKF university who are trying to get out of debt and build wealth should understand there is a sweet spot for those who find themselves in the market to purchase specific products. We’re not saying you can’t succeed if you venture slightly outside of these suggestions; again this is simply the sweet spot or set of purchase points you want to aim for so you do not find yourself too far off track.

A few good BKF approved purchase points for individual items you may be trying to obtain are as follows:

===========================

**Houses**

You should be out of all non student loan debt, have an emergency fund of 6 months expenses, and don’t buy anything unless your total monthly real estate expenses are below 33% of your gross monthly income. (Prop taxes, Home warranty, hazard insurance, maintenance, utilities etc). Avoid 1 level condos.

Learn more here.

And even better than that? Smart people who feel they need houses and want to actually be wealthy, here’s how to buy them in cash here.

**For NEW Cars**

You should not be driving a new anything while you’re in debt. Especially not consumer debt.

For those who refuse to listen and only have student loan debt left, understand that the absolute least expensive form of automobile is leasing the 100% electric car under $28k. Take out a 36 month pre-paid in cash lease which allows you a car pool lane sticker, a $2500 check from the state of CA sent to your house, a car with virtually no maintenance and virtually no fuel costs. Learn more about the leasing portion of this here.

**When purchasing a car if yours has become too expensive to fix**

Over 3 years old, reliable (Honda, Toyota/Scion, Nissan), $12k or under and paid for in CASH. If you do not have $12k to purchase a vehicle and you only have $6k to purchase a vehicle then great, thats even better – you know what you can afford. “I can afford it” means you “have the cash to purchase said item”.

**GAS**

Chevron gas preferred. Second choice is Texaco 91. Third choice is 76. Stay clear away from Arco and Costco gas. Contrary to popular belief all gas is not created equal and a lot of us spend a whole lot more burning through cheap gas. Visit facebook.com/jplynn to view our photo album of social media feedback from our 3 month gas challenge.

**For Car Insurance**

Progressive Insurance (www.progressive.com), http://www.WawanesaGeneral.com, AAA.com and http://www.Metromile.com (per mile insurance).

**Transportation in General**

(For the smart ones trying to wean themselves off of owning/using cars altogether, the best type of transportation is a creative mix of the below while keeping an old reliable clunker parked on the street for emergencies:)

>Bikes:

Most affordable & portable for transportation:

http://www.citizenbike.com/catalog.asp

Fastest & most portable for both transportation and leisure:

http://www.ternbicycles.com/us/

Not as portable but high quality full sized bikes for transportation and leisure:

http://www.montaguebikes.com/

Strictly for leisure

http://www.panamajack.com/eSource3/items/items-3-S1-lV1Shop-lV2Bikes-lV3Bikes.aspx?store

Most affordable high quality electric bikes for transportation and lesiure:

http://prodecotech.com/

Many cities now have bike rental services as well.

Electric longboards (latest technology) coming soon:

http://www.youtube.com/watch?v=IWV8irg64oM

Public Transportation:

Metro 30 day pass (or whatever your local bus/train pass is called)

http://www.metro.net/riding/fares/

Ride Share & Hourly Car rentals:

Uber, Lyft, Relayrides, Sidecar (www.side.cr), Zimride or Zipcar

Couple two of the alt transportation methods above with the purchase of a $3k-$6k reliable Honda Toyota or Nissan that stays parked at your house the majority of the month and you can’t lose!

**For new laptops needed for work or school**

Between $225-$600 (never pay over $600 for a laptop while in debt) HP, Sony, Toshiba, Asus, Acer or Samsung. The Microsoft Surface is great for many people that want extreme portability and full computing functions. Apple if you’re an art director, graphic designer or special effects editor. Just say no to Chrome Books.

**For inexpensive cell phone external batteries and accessories** (will save your life)

www.NewTrent.com

www.LimeFuel.com

**For banking products/bank accounts**

Checking Accounts- must have “free” checking or the ability to avoid account maintenance fees using direct deposit. No mandatory transferring of money between to avoid fees. Must have ALL overdraft “protection” removed from accounts.

**Checking accounts can be from the following:**

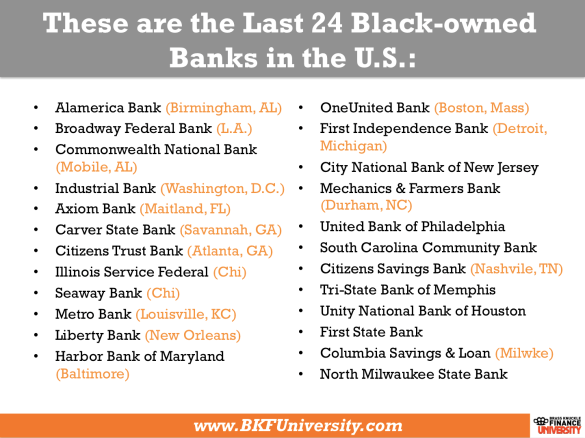

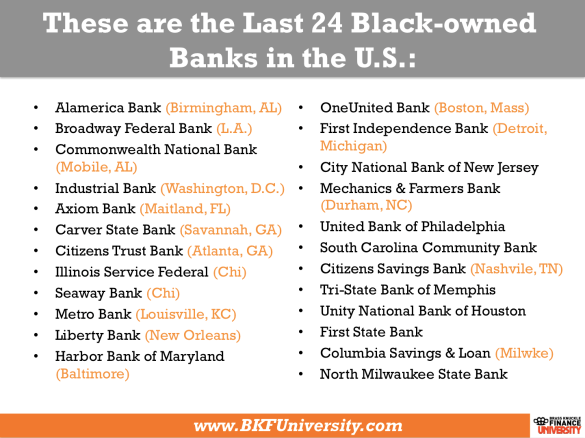

One or more of the following Black owned banks:

Bank of America (the free eBanking account has been phased out – use MyAccess checking)

Allybank.com

USAA.com

Unionbank.com

Schwab.com

Wellsfargo.com

USBank.com

Credit unions/community banks

>>Stay away from Chase!

**Savings Accounts:**

One of the Black owned banks listed previously

Capitalone360.com

USAA.com

Allybank.com (must have a clean-ish credit report)

FNBODirect.com

Everbank.com

Credit unions/community banks

**Investment Accounts**

TDAmeritrade.com

Vanguard.com

Betterment.com

**Financial advisors -investment related**

YOURSELF (read a book like www.BKFInvestingSchool.com and/or joing the investing school program)

You can’t pass down someone else’s app or website that may or may not be in existence, to your kids.

If wanting to discuss a complex estate matter, try Vanguard personal advisor services https://investor.vanguard.com/advice/personal-advisor

**Budgeting/Getting out of Debt Software**

http://www.Mint.com

http://www.readyforzero.com

**For Healthy Eats**

L.A.:

Simply Wholesome (black owned – Los Angeles) http://www.yelp.com/biz/simply-wholesome-los-angeles

Stuff I eat (black owned – Inglewood) http://www.yelp.com/biz/stuff-i-eat-inglewood

Mo Better Burgers (black owned -check out their veggie burger and veggie tacos – Mid Wilshire) http://www.yelp.com/biz/mo-better-burgers-los-angeles-2

Derrick’s Jamaican Cuisine (black owned – Ladera) http://www.yelp.com/biz/derricks-jamaican-cuisine-los-angeles

**For cable TV packages**

AVOID Cable TV – this does not enhance your life. Use Hulu/Netflix or various free tv/free movies services online.

For stand alone digital boxes, use the Roku 3 player, Apple TV, Amazon Fire TV or Chromecast. (Roku is the best option right now for those who do not have Apple laptops. For those who have Apple laptops and use AirPlay to beam all types of content to your TV, the new Apple TV is best)

**For cell phone service**

Cell phone service is a highly subjective field. You have to try a few and settle with the one you like. You also have to go with the one that offers the best package for what you need. Some people only use 500mb of data and aren’t affected by throttling after that for example.

Cricket (https://www.cricketwireless.com) <– bought by AT&T. Offers a prepaid feature phone plan with unlimited talk, text and data (2.5mb at high speed) for $40.

Ting Wireless (https://ting.com) <–uses Sprint’s network

Straight Talk Wireless (http://www.straighttalk.com/) <– depending on your location, will use AT&T, T-Mobile, Verizon & Sprint’s towers)

Republic Wireless (https://republicwireless.com) <–uses Sprint’s network

Boost Mobile (https://www.boostmobile.com) <–uses Sprint’s network

Virgin Mobile (http://www.virginmobileusa.com) <– uses Sprint’s network

Metro PCS (http://www.metropcs.com) <– uses T.Mobile’s network

>>Note: Verizon and others are far too expensive for mediocre benefits!

**For Internet providers**

Stick to Time Warner cable or Comcast over ATT Uverse. ClearWire sucks (and will be out of busines ssoon). DirecTV if you hate your money.