“How do I build up my credit report??”

A question I get on a daily basis in my line of work. The answer takes a bit of reprogramming to understand, however.

Brace yourself, I am going to explain something to you that no one wants you to know:

With a clean credit report and money in the bank, you can do anything on earth.

“What? No! Blasphemy!”

Yes indeed. But whats probably less heard of? Me explaining to you that the way to get said money in the bank is to stop “building” and otherwise using credit.

Your credit report is simply a list of public filings, loan obligations and how you’ve handled those loan obligations. There is nothing to build up. Those of us with money, keep our reports clean with little as possible on it. Again – with a clean credit report you can do anything.

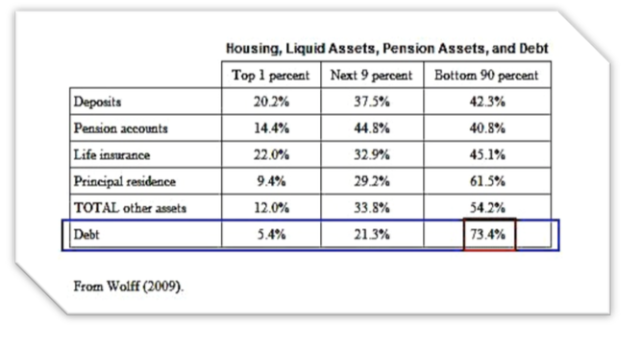

What most people refer to in”building up” is a credit score. That credit score, which calculates the riskiness of providing you a loan, is completely worthless in wealth building. Poor people are taught to stay in debt with loan products while the wealthy lend those poor people money and then teach their kids to invest in the companies/banks that lend those same poor people money.

Instead, what should be focused on being built up – for anyone wishing to achieve wealth – is your investment portfolio. That portfolio should be funded with cash as I do mine. Our courses will teach you how to do so when you’re ready.

Recap: your credit report is to be kept clean with no new entries. Your credit score is worthless to in regards to wealth building so never attempt to build anything on it. Again – the only reason to use a credit score is to get into debt you shouldn’t have been in in the first place.

Your cash reserves and investments are what you should focus on building. When you pay no one interest each month, you’ll see the snowball effect of a positive cash-flow, investment appreciation and compound interest. Its amazing.

From this day forth, you can pay attention or pay interest.

For those interested in paying attention while everyone else around you remains broke, read Course 3 on

http://www.brassknucklefinance.com

But while I have you here, lets knock out a few false myths shall we?

1. “You need credit to be financially successful in America.” <<No, you need credit to get into debt. And you need debt to work for the rest of your life at dead end jobs just to pay for it.

2. “Using credit cards responsibly can be beneficial.” << No, the term “using credit cards responsibly” is an oxymoron. Credit cards were set up from jump to get and keep you in debt. To use credit cards the way they were meant to be used, you would need to never pay cash for anything, keep a maxed out revolving balance, send in your payments late EACH month and take advantage of those awesome cash advances charging you tons of interest ontop of the interest you’re already paying.

Don’t believe me? Google why the credit card industry refers to the few who pay off their credit cards each month as “dead beats”. Sooner or later you will fall into the trap because thats how it was designed. And even if you don’t, the risk reward is so small -40 years of paying interest to get some reward points? For real?

Come on son.

3. “If I dont carry a credit card and a balance on that credit card then I wont be able to build my credit score.” << And the reason you’re trying to build your credit score again is…? You need to understand that wealthy people don’t rely on credit. They use the CASH they have access to and live within their means. No, im not talking about the folks runnin around L.A. in beamers who you THINK are wealthy. I’m talking about the truly wealthy – the Warren Buffetts and Carlos Slims of the world.

“I’m basically against debt. The average individual will live a lot happier life if…”

– Billionaire Warren Buffett

https://www.youtube.com/watch?v=QchxO-M8zeA

“My only advice is to stay away from credit cards”

at :2min – Warren Buffett http://www.youtube.com/watch?v=4BJfEI3o0rY

“If you use a credit card, you don’t want to be rich”

– Mark Cuban (billionaire)

“The best place to invest is to pay off all your credit cards and then burn them” – Billionaire Mark Cuban starting at :56 sec –>> http://youtu.be/KA0IUaoXSew

“Avoid credit cards and start saving” Billionaire Warren Buffett to college grads (7:40sec)—>> https://www.youtube.com/watch?v=0Te4oM-HWoI

The CEO of the world’s largest mutual fund company, Vanguard, explains why he refuses to use credit cards —>> http://time.com/?post_type=money_article&p=3889640?xid=tcoshare

“Boy you gotta supplement yo income wit dem reward points!”

– yo broke a$$ uncle Tony

Furthermore, you need to understand that the only reason someone would build up a credit score is to potentially use it. You should NEVER voluntarily become someones slave and thats what comes from the use of credit –> debt. There is nothing on earth you need to get into debt to buy and definitely nothing thats beneficial to you. All you have to do is focus on living within your means. Its really not complicated at all.

4. “I need to build my credit score because without it I cant get a job, rent an apartment or rent a car.”<<FALSE. #1, Employers look at your credit REPORT not SCORE. Read this directly from the employee privacy rights org:

An employment background check often includes a copy of your credit report. The three major credit reporting agencies (Experian, TransUnion, and Equifax) provide a modified version of the credit report called an “employment report.” An “employment report” includes information about your credit-payment history and other credit habits from which current or potential employers might draw conclusions about you.An employment report provides everything a standard credit report would provide. However it doesn’t include your credit score or date of birth. Nor does it place an “inquiry” on your credit file that may be seen by a company looking to issue you credit.

As well as from credit expert John Ulzheimer: http://finance.yahoo.com/news/no-employer-cant-check-credit-194739945.html

So in other words, each of us should be attempting to create a CLEAN credit report and not stressing out, opening accounts and taking on debt to build a meaningless credit score.

Next, in regard to renting/leasing apartments, what they won’t tell you is the majority of locations you will attempt to rent will look at your credit REPORT for residential type delinquencies vs your actual credit score. These companies are searching for delinquent water & power bills, evictions and believe it or not only to a lesser extent – bankruptcies. (yes you can lease an apartment quicker with a bankruptcy than you can with outstanding residential type collections and debt.)

As well, when cash and a credit report with no entries are brought to just about any table on Earth, a miraculous thing begins to happen. Approvals appear out of thin air.

Who woulda thunk.

Renting cars- about 80% of car rental agencies accept debit cards. Thats an OVERWHELMING number. Yes, they will place a hold on the funds in whatever account is connected to the debit card but once you start living within your means like I have, you start noticing a very surprising trend – you have WAY more extra money than you did before. A $500 hold on a $10k balance is nothing compared to someone who is living off maxed out credit cards and has a $900 balance waiting for their carnote and other bills to come out.

But even better? Next generation companies like Sidecar, Uber X, Lyft, Zipcar, Relay Rides, Cars2go etc have put in blood sweat and tears to offer new experiences that will also save you a ton of money and trouble. No one should be renting cars from traditional rent-a-car companies in 2015.

So lets get this straight. So far we know credit was meant to be kept clean and credit scores have no determining affect on employment, traveling/renting a car, renting apartments, happiness, or anything else worthy of having in your life. So now you’re asking yourself “well I will never be a home owner or a car owner without a loan and they check your credit score for that dont they?!”

Please allow me to wake you ALL the way up and yank that chord out of your neck:

- Why “your” house is not an investment –> https://thisiswhyubroke.wordpress.com/2013/06/16/why-your-house-is-not-an-investment-specifically/

- How To Buy a House Without the Use of Credit –> https://thisiswhyubroke.wordpress.com/2013/01/16/how-to-buy-a-house-without-using-credit-specifically/

- The Top BKF Transportation Choices –> https://thisiswhyubroke.wordpress.com/2014/11/18/the-bkf-top-5-transportation-choices/

- Is leasing a car better than owning a car? –> https://thisiswhyubroke.wordpress.com/2015/08/15/is-leasing-a-car-better-than-buying-a-car/

- How to Buy a Car Without Using Credit/ The Truth About Financing vs. Leasing –> http://wp.me/pUlp7-4c

- How to lease a car without worrying about a credit score –> https://thisiswhyubroke.wordpress.com/2015/07/31/how-to-lease-a-car-without-worrying-about-a-credit-score-negotiating-a-car-lease-like-a-tiger/

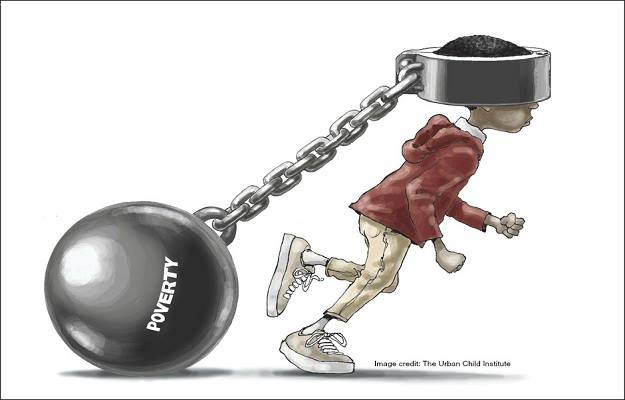

“Debt is modern day slavery in America. Credit is simply the slave ship that got you there” – JarimP.L.

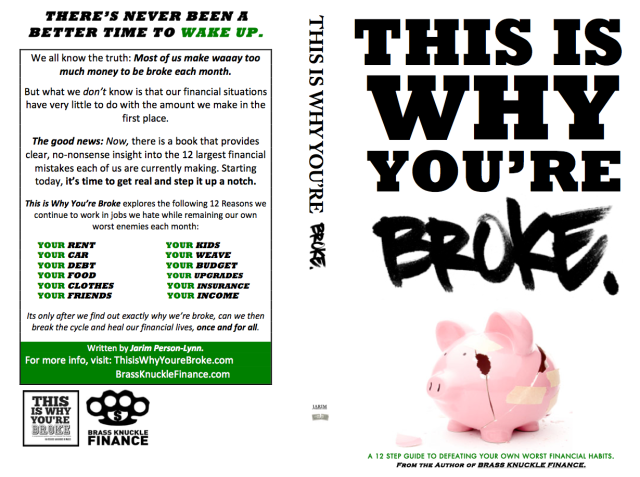

BRASS KNUCKLE FINANCE IS AVAILABLE NOW!

eBook – $4.99 | Hardcopy – $10

The highly acclaimed personal finance book consists of the following 5 course program that promises to not only change the way you view money but change the way you view yourself:

- Course 1 : How your Mentality and Health Directly Affect your Wealth

- Course 2: The True Art of Budgeting & Spending

- Course 3: Getting out of Debt & Staying out of Debt

The eBook is in PDF format with hyperlinks to help you navigate in between courses. $4.99 for the material that I’ve personally used to change thousands of people’s lives in the LA area. With it comes along a free Digital toolkit that contains worksheets, financial videos infographics, calculators and more. All of this for only $4.99. Audio book is available now as well for $10.

VISIT WWW.BRASSKNUCKLEFINANCE.COM FOR MORE INFO.

=================================

What you will learn from this book:

How to decrease specific expenses and beat debt.

How to pay off collection accounts and fix your credit report.

How to purchase a car the right way.

The right types of insurance to purchase.

How to get started investing.

Tips for getting into position to purchase rental income property.

Pingback: Financial Myth Busters Part 1 «

Pingback: Credit Card Pimps «

Awesome!! Cash is King!! I’ve made some major financial mistakes in my past & certainly learned from them. I must check out your other sites/blogs…financing vs. leasing…I was this close *snap* from the pink slip, smh.

LikeLike

Pingback: CreditCardsAreForIDIOTS « ThisIsWhyUBroke.com!